Betfair SPs Might Not be as Efficient as We Think

If you have been trading for some time, you probably know what market efficiency means generally.

You may have heard people say that you can’t win money by trading on Betfair, because the markets are too efficient.

Is this true or is it an assumption?

In fact, there are 2 assumptions embedded in the statement. The first is that the Betfair markets are efficient. The second is the assumption that it is impossible to make money in an efficient market.

In this article, I will dive deeper into the concept of efficiency. In addition, I will discuss:

Whether Betfair markets are efficient.

Whether it is possible to make money from an efficient market.

If you only have a basic knowledge of market efficiency, this article will provide you with a useful insight into the Betfair markets.

The Invalid Argument that Betfair SPs are Highly Efficient

Many traders argue that Betfair SPs are highly efficient. The argument goes as follows:

Premise 1: If you back every favourite, you will lose money.

Premise 2: If you lay every favourite, you will also lose money.

Conclusion: The Betfair SPs are highly efficient.

The premises are correct. Whether the conclusion is correct depends on how you think of efficiency.

Let’s assume that we are talking about horse racing. On average, the Betfair SPs will reflect the true price of favourite.

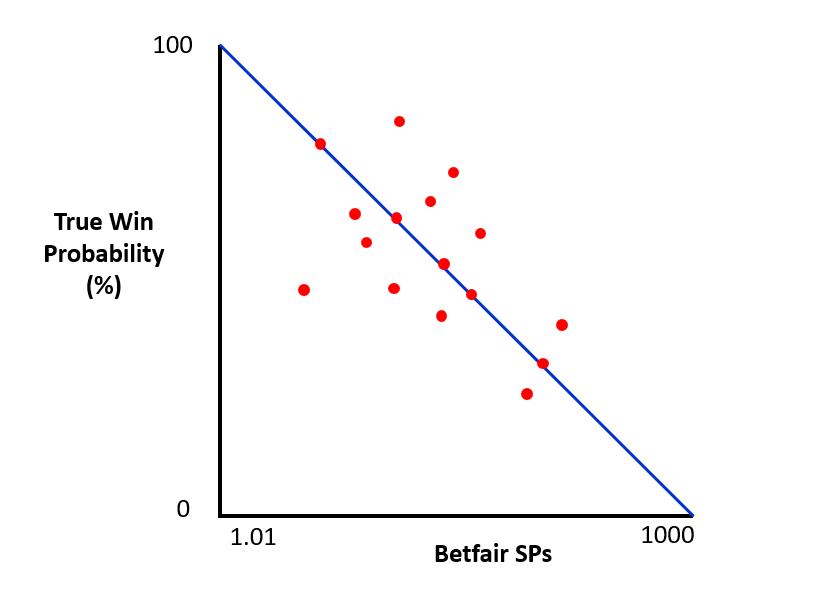

Figure 1: Chart Showing How Betfair Odds May Correspond to True Win Probabilities

In the above chart (Figure 1), the blue diagonal line represents the true probability of the Betfair odds. The red dots represent horses. If their odds represent the true probability, the red dots should appear on the blue line.

However, it’s unlikely that all individual favourites start the race at the correct price. It’s more likely that some will have big odds, compared to their probability of winning. In this case, the dots will fall above the blue line.

There will be others may be short odds, relative to their chance of winning. These will fall below the blue line. When you put the over-priced and under-priced favourites together and calculate an average, Betfair SPs will appear to be efficient.

Therefore, the horses’ odds will be efficient on average or collectively efficient, but not necessarily individually efficient.

Intuitively, it seems almost impossible that a computer can calculate the correct probabilities for all outcomes in sporting events, throughout the year.

Fundamental analysts, who know something about the sport, may be able to take advantage of this possible lack of individual efficiency.

A. The Efficient Market Hypothesis (EMH)

The origins of the Efficient Market Hypothesis (EMH) are derived from the work of Eugene Fama in the 1960s and 70s.

Fama (1970) defined an efficient market as: A market in which prices always “fully reflect” available information.

In other words, he was saying that prices are at the level that they should be at.

1. The 3 Types of Efficiency

Three types of efficiency evolved from Fama’s EMH hypothesis, namely:

- Strong Form Efficiency

- Semi-strong Form Efficiency

- Weak Form Efficiency

The above theories were developed by an economics professor, Burton G. Malkiel (1973) and published in his book, “A Random Walk Down Wall Street.”

I will define these 3 types of efficiency, before I tell you which of these we see on Betfair markets.

a) Strong Form Efficiency

As the name suggests, strong form efficiency is the strongest form of efficiency.

In the stock market, strong form efficiency means that ALL market information is factored into the price of a stock.

This means that the investor can’t gain an advantage from:

- Inside information

- Fundamental analysis

- Technical analysis

As sports traders, it’s easy to jump to the conclusion that, trading is not viable in a strong form efficient market. However, this is not necessarily the case. I will explain later that, certain types of strong form efficient markets, can be good for scalping.

There is an important difference between a strong form efficient market in financials and sports.

That is, financial markets prices are prone to changes due to random news events. For example, if war breaks out on the other side of the world, or the price of oil goes up or people vote for Brexit, this might result in changes in prices in financial markets. However, such events won’t alter the odds of a tennis match at Wimbledon.

Therefore, compared to a financial market, when a sports market is strong form efficient, prices are more likely to be stable. This is why pre-match scalping may be a viable trading strategy in certain strong form efficient markets.

b) Semi-strong Form Efficiency

The fact is that you won’t see many strong form efficient markets on the betting exchanges. However, you will see a lot of semi-strong efficient markets.

Semi-strong form efficiency is the second strongest form of efficiency.

Semi-strong form efficiency asserts that historical and current publicly-available information is factored into the price of a stock.

This means that the investor can’t gain an advantage from:

- Fundamental analysis

- Technical analysis

Unlike strong form efficiency, semi-strong efficiency doesn’t assume that inside information is factored into the price.

Therefore, the investor can gain an advantage from:

- Inside Information

If the market is semi-strong efficient, this implies that only insiders, such as bookmakers and other smart money traders, can win. Again, as with strong form efficient markets, there may be certain conditions in semi-strong markets in which scalping is a viable option.

However, because inside information can influence semi-strong form efficient markets, you could argue that these markets are more difficult to scalp than strong form efficient markets.

I will talk more about, how to find situations, in which inside information has a reduced effect on scalping, later in this article.

c) Weak Form Efficiency

Weak form efficiency contends that past price movements do not affect current or future prices. Weak form efficiency asserts that historical and current publicly-available information is factored into the price of a stock.

This means that you can’t gain an advantage from Technical analysis

However, according to the theory, the investor can gain an advantage from:

- Insider information

- Fundamental analysis

Weak form efficiency is similar to semi-strong form efficiency. The only clear difference is that the theory concedes that traders can find an edge by using fundamental analysis in a weak form efficient market. We can potentially make money by trading in a weak form efficient market.

B. How Can You Tell the Level of Market Efficiency?

In sports trading, we can narrow down the type of efficiency of the market. We can’t always determine the exact level of efficiency of a market. However, we can often exclude strong form efficiency.

1. Semi-strong Form Efficient Market (at best)

If the market moves in either direction, in response to previously private news, the maximum efficiency level of the market is the semi-strong form. This is because strong form efficiency asserts that previously private news, is already factored into the odds.

For example, if a well-known tipster releases a tip and this results in the market to move, this means that the market is not strong form efficient. Such a market will be semi-strong efficient, at best.

Similarly, when the odds move in football match market, just after the team sheets are published, this suggests that the market is semi-strong efficient, at best.

2. Weak Form Efficient Market (at best)

To show that a market is weak-form efficient, there has to be a mispricing in the market that can be picked up by fundamental analysis. This is difficult for the individual trader to prove. However, there is published research that shows that mispricings do occur.

Several studies suggest that the betting markets are weak form efficient (see Angelini and Angelis, 2018). For example, computer-based forecasting models have been shown to produce profits for a wide range of sports, including:

- Tennis

- Horse racing

- Football (soccer)

- Australian Rules football

- American football

(for references, see Angelini and Angelis, 2018).

The computer-based models used a combination of form-based and statistical inputs. Many of these studies used bookmakers and not betting exchanges. As betting exchanges give better odds and have a smaller overround than bookmakers, the authors of some of these studies would probably have obtained superior results if they had used betting exchanges, instead of bookmakers.

The other thing that I should point out, is that these computer-based models weren’t trading models. They were forecasting the results of sporting events. Nevertheless, they show that many betting markets are weak form efficient.

3. Inefficient Market

So, I haven’t discussed inefficient markets yet.

An inefficient market is when the price is incorrect and there are other market characteristics, that don’t fit into any of the EMH definitions of efficiency.

Therefore, an inefficient market must have mispricing, together with at least one of the following:

Past price movements affect current or future prices.

Historical or current publicly-available information is not factored into the price.

For example, during the coronavirus-induced “ghost” games, in which football teams played in empty stadiums, Meier et al. (2021) found that the odds of home teams were mispriced too low. The mispricings were sufficient for a trader or punter to make an overall profit. As the information that teams were playing in empty stadiums was public news, the authors concluded that these markets were weak-form efficient, at best.

However, I would call that inefficient, rather than weak-form efficient. The reason for this is that the information that the teams were playing in empty stadiums was public. For a market to be classed as weak-form efficient, public information should be factored into the odds.

4. Markets are Not Static

An important idea is that sports markets aren’t static. They can change their level of efficiency throughout the day.

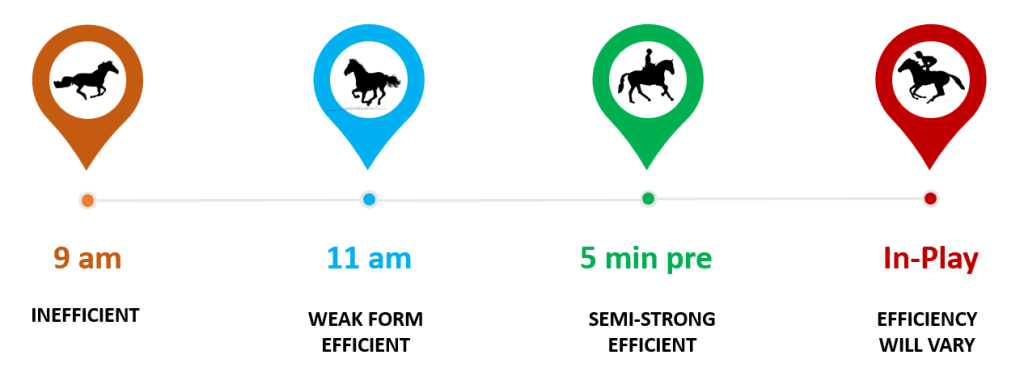

Figure 2: How a Horse Racing Market Might Develop

Figure 2 is an example of how a horse race market might develop. At 9 am, when liquidity is low, the market might be inefficient. As money comes into the market, it might become weak-form efficient (11 am). As you get close to the start of the race (5 minutes pre-race), large amounts of informed money start to come into the market, which may lead to a semi-strong efficient market.

Then, the race goes in-play. During this time, liquidity reduces, which may result in the efficiency level of the market to vary. I’m not saying that a horse race market unfolds in exactly this manner. The point that I am trying to get across is that it is likely that efficiency varies in such markets. In addition, it is also likely that the market becomes more efficient as it approaches the start of the race.

C. What Causes Inefficiency in a Market?

In finance, the word “anomaly” is used to refer to prices that don’t fit into the efficient market hypothesis.

There are 2 types of anomalies, which include:

Market anomalies

Pricing anomalies

I will discuss both types of anomalies.

1. Market Anomalies

Market anomalies are patterns of price change that contradict the EMH. The important feature of a market anomaly is that there is a pattern, that suggests that there is a regular bias in the market.

a) The “Monday” Effect

In financial markets, an example of a market anomaly is the “Weekend Effect” (aka the “Monday Effect”). This refers to reports that Monday’s prices tend to close lower than those of the immediately preceding Friday (Cross, 1973). In addition, volume is lower on Monday, compared to Friday and there tends to be more sellers than buyers in markets.

b) The Favourite-Longshot Bias

In sports, an example of a market anomaly is the favourite-longshot bias (FLB). I’ve written a whole chapter on the FLB in my free eBook, “DOBBing for Profit”, that you can find on the sidebar on my website.

The favourite-longshot bias is a phenomenon in betting, whereby punters tend to:

Overestimate the value of long-shots AND

Underestimate the value of favourites (eg Shin, 1991)

Effectively, this means that favourites are better value than long-shots at bookmakers. However, due to the bookmakers’ overround, betting on favourites still isn’t a profitable bet. Basically, the FLB means that favourites are -EV, while outsiders are even more -EV.

Another example of a market anomaly in sports, are trainer betting patterns. For example, I have said in other videos and in my book, “Directional Trading on Horse-Racing” that I have noticed certain trainers’ well-handicapped horses get backed at a specific time and that the timing of the backing is dependent on the trainer. This is if the horse is going for the win.

2. Pricing Anomalies

Pricing anomalies are when the price of a stock (or in sports trading, a horse) is priced differently, compared to EMH predictions.

This type of market inefficiency may be due to:

Low liquidity

Informational asymmetry (differences in opinion in which one party has more information than the other)

The above causes of market inefficiency will be discussed.

a) Low Liquidity

Although betting exchange markets parallel bookmaker markets, there may be moments where the betting exchange odds diverge from efficiency. Many of such moments may occur when there is low liquidity in the market.

(i) Temporary Inefficiency Due to Low Liquidity

In weak morning markets, different traders and punters can look at form or statistics of a sporting event and come up with different conclusions. In such markets, it wouldn’t take a lot of money to move the odds by several ticks.

Many in-play markets are weak. The odds might not always change to efficient values when responding to new information. Examples of new information include goals and red cards in football. In such cases, odds may be temporarily affected by human error and emotions. As such, some markets may over-react, while others may under-react.

(ii) Low Liquidity Markets are Potentially Profitable if You Have an Angle

The fact that low liquidity is associated with market inefficiency is important. We are often told by YouTubers that we shouldn’t trade when liquidity is low. The argument is that you can’t trade a large amount of money in a low liquidity market. However, compared to highly liquid markets, low liquidity markets are often volatile. Therefore, low liquidity markets offer the potential to make more money relative to size of your stake.

The theory is that a highly active market will become more efficient because inside information bets will enter the market from a range of sources. The situation is complicated more because inside information money enters the market at different times. In addition, there will be bookmakers and other smart money, profiting by correcting inefficiencies.

This doesn’t mean we can’t trade in high volume markets. Whether a market is efficient or inefficient, you need to have an edge to trade successfully. If you don’t have an angle, you can still lose in an inefficient market

b) Informational Asymmetry

Differences in opinion in which one party has more information than the other is known as “informational asymmetry”. In this context, we are usually talking about informed traders, with private information, having an advantage over other traders.

(i) Informed Traders versus Uninformed Traders

In a paper by Admati and Pfleiderer (1988), financial traders were divided into informed traders and liquidity traders.

Informed traders were classed as traders with private information. By contrast, liquidity trainers do not have private information. Liquidity traders might include large financial institutions, who are buying shares for clients. Therefore, liquidity traders might not be trading for the purpose of getting a short-term gain. However, they are still trying to get the best price.

The authors found that liquidity traders obtained better prices when:

There were many informed traders in the market AND

The informed traders had the same information (ie the informed traders all had the same opinion)

In this situation, the liquidity traders are not beating the efficient market. They are simply obtaining a fair price. By contrast, in a market, that is prone to inefficiency, the liquidity traders will obtain bad prices on average. This is because they do not have inside information.

This makes sense.

If there are many informed traders, with the same opinion, they will compete with each other to correct an inefficient market. In this case, the market will always hover around the efficient price.

By contrast, if the informed traders have different opinions, the market could swing in both directions. In this situation, the liquidity traders won’t know the final direction of the prices.

If there is only one informed trader or a group working together, they will often hide what they are doing by making relatively small trades (Borghesi, 2016). In this situation, the liquidity trader will find it difficult, or impossible, to read the market.

In the context of trading on sports, we can reach important conclusions from these findings.

(ii) Market Conditions in Which Scalping is Potentially Profitable

For scalping, the following 2 conditions may be preferred:

- A strong market (high liquidity)

- The sporting event has few possible outcomes

Why is this ideal for scalping?

Firstly, a strong, highly liquid market is likely to attract many informed traders. These traders will compete with each other to bring to the odds to their efficient positions.

Secondly, if there are fewer possible outcomes, it is more likely that the informed money will be in agreement. For example, if you have a choice between scalping a tennis match or a football match (and all other variables are equal), the tennis match should be preferable. This is because, a tennis match has 2 possible outcomes, while a football match has 3 possible outcomes.

There is still the issue of whether the informed traders, agree on the odds of the tennis players. However, the less informed trader can trade in a direction, if he knows which outcome the informed traders have chosen.

D. What Does this All Mean for Sports Traders?

The subtitle of this article was, “It Is Possible To Find An Edge In An Efficient Market”. Under the right conditions, I have explained that there is potential to make money trading in markets that have various levels of efficiency. In this article, I’ve explained what I mean by the right conditions.

1. Are Betfair Markets Efficient?

Are Betfair markets strong, semi-strong, or weak form efficient or inefficient? The answer to that question is that you will find all 4 types of markets at Betfair.

a) Strong Form Market Example

For example, in some Australian horse races, during the first lockdown, the odds didn’t move during the last 5 minutes pre-race. This would be an example of a strong form efficient market. You won’t see such markets often. I don’t really like using this as an example, because in the races I saw, hardly any volume was getting traded despite the large amount of liquidity available. So, I don’t think that you will find many strong form markets.

b) Semi-Strong Form Market Example

You will find a lot of semi-strong efficient markets at Betfair. For example, in football, when a goal scored during the 5 minutes before half-time, the market has been reported to adjust quickly (Croxson and Reade, 2014). In this particular situation, the market is believed to be semi-strong because it reacts quickly and accurately to new information. This is a specific situation and it doesn’t mean that all in-play situations are semi-strong efficient.

c) Weak Form Market Example

Many studies suggest that the betting markets are weak form efficient (see Angelini and Angelis, 2018). For example, computer-based forecasting models have been shown to produce profits for American football, tennis, horse racing and Australian Rules football (for references, see Angelini and Angelis, 2018).

d) Inefficient Market Example

An example of an inefficient market was the Meier et al., (2021) study, in which he found that the markets overestimated the winning chances of home teams, during the coronavirus-induced “ghost matches”.

2. The Trading Game is About Finding Edges

It is important for the sports trader to find an edge. By definition, inefficient and weak form efficient markets have potential edges within them. The challenge is to find these edges.

In high liquidity sporting events with few possible outcomes, high liquidity, strong and semi-strong form efficient markets may be ok to scalp. In this case, you have to judge whether the informed traders are in agreement with each other. There is always a risk that there could be an informed trader, with a different opinion, waiting to take the market by surprise.

I would say that, to trade successfully, you need learn to find anomalies. The markets are not very liquid these days. Therefore, there are fewer opportunities to scalp strong markets.

3. The Pros and Cons of Using the Efficient Market Hypothesis

Although the efficient market hypothesis is, by definition, unproven, it does provide a useful way of classifying markets. The classification system can help us to decide whether we should trade a market. In addition, the system gives us an awareness of which methods that we should be using in each type of market.

The disadvantage is that it may cause a trader to give up on a market too early. Let’s say that you look at a market and you can’t find an edge. Therefore, you decide that the market is semi-strong efficient. As you don’t have inside information, you move on. However, there could be anomalies in that market, but you haven’t found them, yet. Therefore, the market could look semi-strong to a trader, who hasn’t found an anomaly. However, there could be a another trader, who sees the same market as inefficient, because he has found anomalies.

The same argument could be used on any individual (including academic researchers), who claims that a market is too efficient to trade in. The individual might not have found an anomaly yet.

References

Admati, A. R. and Pfleiderer, P. (1988). A Theory of Intraday Patterns: Volume and Price Variability. The Review of Financial Studies, 1(1), 3–40. http://www.jstor.org/stable/2962125

Angelini, G. and De Angelis, L. (2018). Efficiency of online football betting markets. International Journal of Forecasting. 35. SSRN Electronic Journal. 10.2139/ssrn.3070329.

Borghesi, R. (2016). Liquidity, Overpricing, and the Tactics of Informed Traders. 10.1007/s12197-016-9375-5.

Croxson, K. and Reade, J. (2014), Information and Efficiency: Goal Arrival in Soccer Betting. Econ J, 124: 62-91. https://doi.org/10.1111/ecoj.12033

Fama, E. F. (1970), Efficient capital markets: A review of theory and empirical work, The Journal of Finance 25(2), 383–417. 10.2307/2325486.

Malkiel, B.G. (1973) “A Random Walk Down Wall Street: The Time-tested Strategy for Successful Investing. https://books.google.co.uk/books?id=_0LM5sH5FhEC&printsec=frontcover&dq=A+Random+Walk+Down+Wall+Street+malkiel&hl=en&newbks=1&newbks_redir=0&sa=X&redir_esc=y#v=onepage&q&f=false

Meier, P.F., Flepp, R. and Franck, E. (2021). “Are sports betting markets semistrong efficient? Evidence from the COVID-19 pandemic,” Working Papers 387, University of Zurich, Department of Business Administration (IBW). https://ideas.repec.org/p/zrh/wpaper/387.html

Shin, H. S. (1991). Optimal Betting Odds against Insider Traders. Economic Journal, 101, 1179-1185. doi.org/10.2307/2234434

![[Solved] Betfair Trading: It is Possible to Find an Edge in an Efficient Market](https://exploitativebetting.co.uk/wp-content/uploads/2024/07/Efficiancy-4.png)