The short answer is that the big bookmakers control the sports market odds. They are the market makers. They decide on the opening odds, closing odds and all the odds in between.

Understanding who influences the odds is essential for trading and betting.

In this article, I will present detailed explanation why I am sure that bookmakers decide on the odds in sports markets.

A. Bookmakers Take a Position in the Market

A popular belief of many punters is that the sports betting markets are allowed to run freely and that market forces are the sole determinant of the bookmakers’ odds.

This is unlikely to be true.

According to the research, bookmakers predict which team punters are likely to bet on. Then, they set prices to exploit the biases of punters (Levitt, 2004).

This is obviously important when reading the market.

1. Sentiment Bias

When the sentiment and opinions of punters are skewed towards a particular team, how does this affect market prices?

There has been research on NFL, baseball, basketball and soccer.

a) Bookmakers Offer Bad Odds on the Punters’ Preferred Team in USA Bookmaker Markets

A paper by Avery and Chevalier (1999) illustrates that betting on “glamourous” teams in the American NFL at bookmakers results in abnormally high losses.

Levitt (2004) suggests that if punters prefer a particular team, the bookmakers will adjust the market, such that they will offer worse odds on the punters’ choice of team.

Strumpf (2003) reported that illegal New York bookmakers offer worse odds on New York teams compared to non-local Las Vegas bookmakers.

b) Bookmakers Offer Better Odds on the Punters’ Preferred Team in Spanish La Liga 1 Football

In a study on a Spanish La Liga 1 football market, Forrest and Simmons (2008) found an opposite bias to the above studies. They found that internet bookmakers offered better prices for popular teams in the Spanish La Liga 1.

There are several possible explanations for the difference in the results of the studies of the US markets and the Spanish market.

Firstly, the American markets are more monopolistic, compared to European markets (Forrest and Simmons, 2008). Therefore, the bookmakers are likely to be competing for punters’ money in European markets. This would have the effect of driving prices higher.

Secondly, the Spanish La Liga study was reported in 2008, which was later, compared to the other studies. It’s likely that there would be more bookmakers online when the more recent study was conducted, relative to earlier studies. Again, this would result in more competition between bookmakers, which would result in higher prices.

Although the higher prices in the Spanish Liga study were not sufficient to turn a profit, the losses by betting on the punters’ choice was significantly less than random betting.

2. Bookmakers do Not Balance their Books

Based on information provided by Las Vegas betting industry sources, Forrest and Simmons (2008) report that bookmakers to not attempt to balance their books.

In the US, the illegal betting sector is larger than the legal sector. An investigation of illegal bookmaker accounts, suggest that such bookmakers take large positions in the market. These bookmakers stand to make substantial losses when a particular team wins (Forrest and Simmons, 2008).

UK bookmakers commonly report substantial losses or wins depending on whether the England football team wins. The losses and wins are large enough to affect the bookmakers’ annual profits (Forrest and Simmons, 2008).

B. Bookmakers’ Odds Appear to Follow Betfair’s Odds – This Doesn’t Mean that Betfair Decides the Odds

Many people believe that the odds are decided by the betting exchanges and the bookmakers follow the exchanges. They might be correct that bookmakers’ odds follow the Betfair prices. However, the interpretation of this may be up for debate.

If the bookmakers’ odds follow Betfair odds, it doesn’t necessarily mean that the bookmakers are not in control of the odds.

1. The Bookmakers are Active on the Betting Exchanges

“Bookmakers participate in the exchange football match result markets themselves, not only to hedge but also to profit from the mispricing and any arbitrage” – Angelini et al. (2022)

I’ve also explained that bookmakers are active in the Betfair markets in my YouTube series, “How to Read Horse Racing Markets for Trading” and in my #1 Best Selling Amazon Book “Directional Trading on Horse Racing: Red Pill Trading”.

2. Bookmakers Might Use Betfair as a Testing Ground

The bookmakers might use the exchange to test how punters react to higher or lower odds before moving the odds on their own website.

For example, they might move a horse’s odds from 2.0 to 2.1 on the exchange and wait to see if the higher price gets taken. If the price doesn’t get taken, they might keep moving the odds up (in small steps) on Betfair until the price is taken.

While the bookies are increasing the odds on Betfair, their own odds will trail behind. This would give the impression that the bookmakers are following the Betfair odds.

There are many variations of this idea, whereby it would appear that the bookmakers’ odds are following the Betfair odds.

Remember, there is low liquidity on Betfair, hours before most races. Therefore, it wouldn’t cost them much to do this.

3. Betfair is Too Small to Be in Control of the Sports Markets

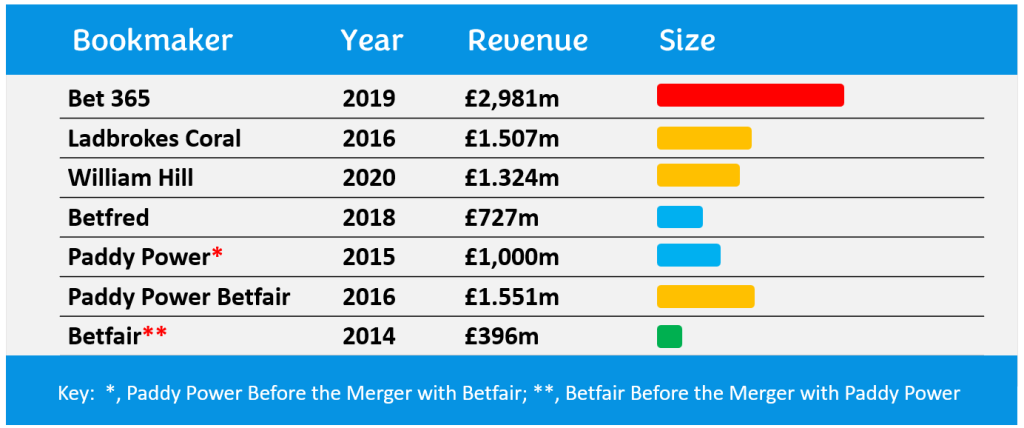

As a company, Betfair is small compared to the bookmakers.

Paddy Power’s revenue was around 2.5x as much as Betfair’s when they merged.

Although I haven’t got comparable dates, Bet365’s (2019) revenue was 7.5x that of Betfair’s (2014) revenue.

Ladbrokes Coral’s revenue was about the same as Paddy Power Betfair’s in 2016.

In addition, Betfair isn’t just an exchange. It is a sportsbook as well.

Therefore, the exchange is tiny, compared to all bookmakers/sportsbooks combined.

Why would bookmakers follow a relatively small company, with such small liquidity (early in the day)?

C. Conclusions

Reading the market involves figuring out what is occurring behind the odds. If you get the underlying theoretical foundations wrong, you can’t read the market.

Although we can’t be 100% sure of how the market works, the evidence strongly suggests that the bookmakers are in control of the sports markets.

Firstly, the literature suggests that bookmakers predict the selections that punters are likely to bet on. Then, they adjust the odds to make most profit for themselves. This means that the punters are only likely to be moving markets significantly when the bookmakers get their predictions wrong on how punters are likely to respond to a market.

Secondly, the bookmakers are active on the betting exchanges. They could be using the exchanges for many purposes, including testing higher and lower odds.

Thirdly, the Betfair Exchange is too small, compared to the big bookmakers and compared to the combined total of the bookmakers, to be in control of the market.

Fourthly, some of the big bookmakers provide a market for some small horse races before the market forms on Betfair.

The bookmakers managed to make sports markets before Betfair came along. I don’t think that Betfair has changed this.

References

Angelini, G., De Angelis, L. & Singleton, C. Informational efficiency and behaviour within in-play prediction markets, International Journal of Forecasting, 38, 1, (282-299), (2022). https://www.researchgate.net/publication/352960912_Informational_efficiency_and_behaviour_within_in-play_prediction_markets

Avery, C., & Chevalier, J. (1999). Identifying Investor Sentiment from Price Paths: The Case of Football Betting. The Journal of Business, 72(4), 493–521. https://doi.org/10.1086/209625

Forrest, D. & Simmons, R. (2008): Sentiment in the betting market on Spanish football, Applied Economics, 40:1, 119-126 To link to this article: http://dx.doi.org/10.1080/0003684070152289

Levitt, S.D. (2004), Why are gambling markets organised so differently from financial markets?. The Economic Journal, 114: 223-246. https://doi.org/10.1111/j.1468-0297.2004.00207.x

Strumpf, K. (2002) “Illegal Sports Bookmakers,” Mimeo, University of North Carolina Department of Economics. 181.pdf (chicagobooth.edu)